AI-Powered Decision Engine

for Commodity Buyers & Traders

Datapred helps energy and commodity buyers optimize procurement, manage risks, and make data-driven decisions — all on a single, connected platform.

Become the smartest buyer:

Know when and how much to buy,

and save 2-5% on your total procurement cost

How Datapred Works

Optimize your purchasing & hedging strategies with our 3 modules.

First results available in 6-8 weeks, refinable as needed to meet more advanced requirements.

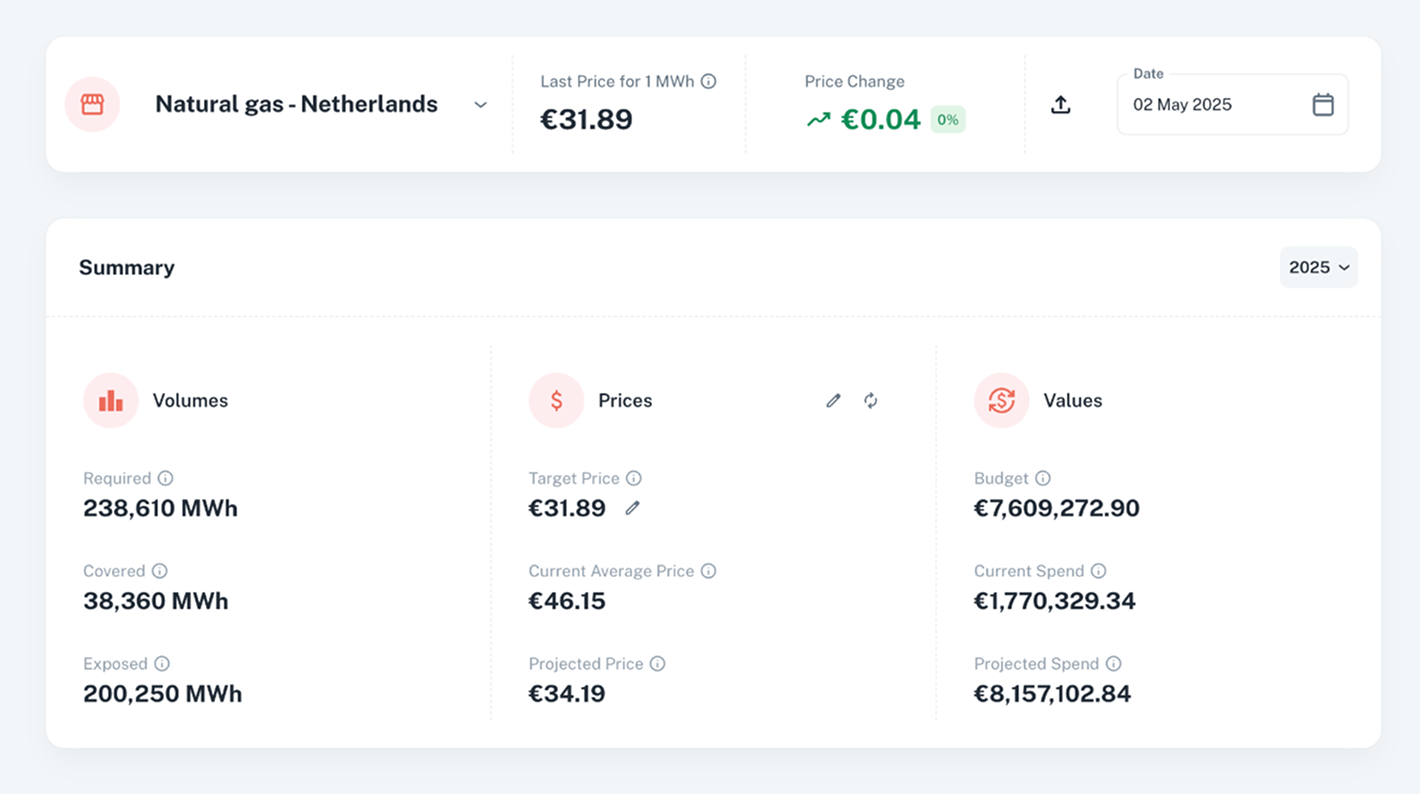

Consolidate and Visualize Energy & Raw Material Consumption

Benefit

Benefit

Eliminate spreadsheet chaos - no more juggling 45 Excel files. Save time with a structured, transparent, and actionable data overview.

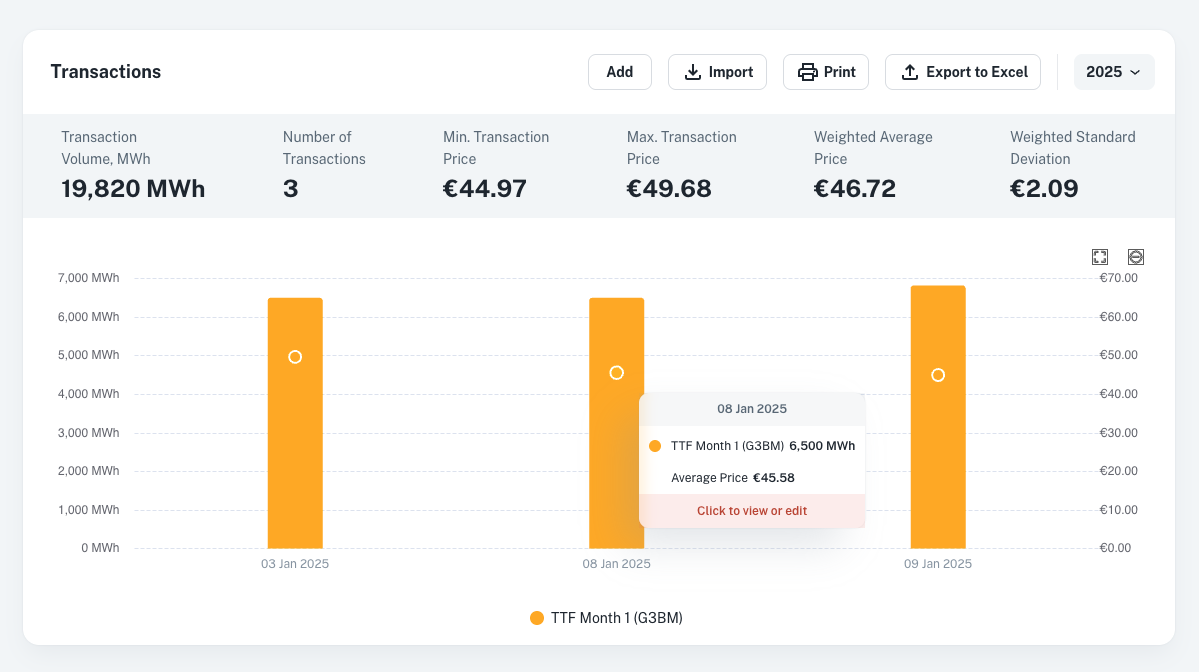

Centralize and Analyze All Historical Transactions

Benefit

Benefit

Boost efficiency and clarity - replace scattered files with a single, intuitive platform offering real-time insights into your procurement history.

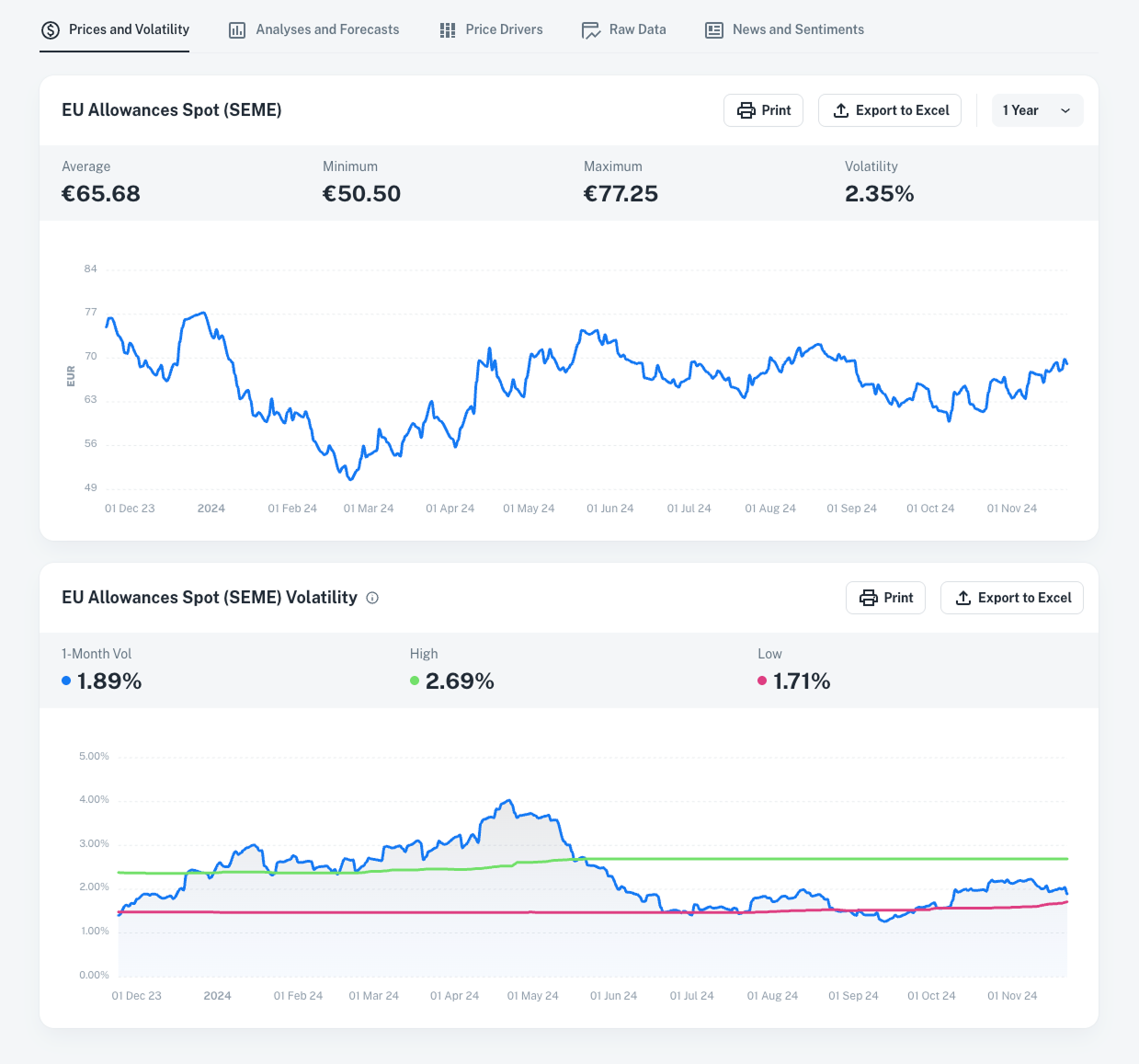

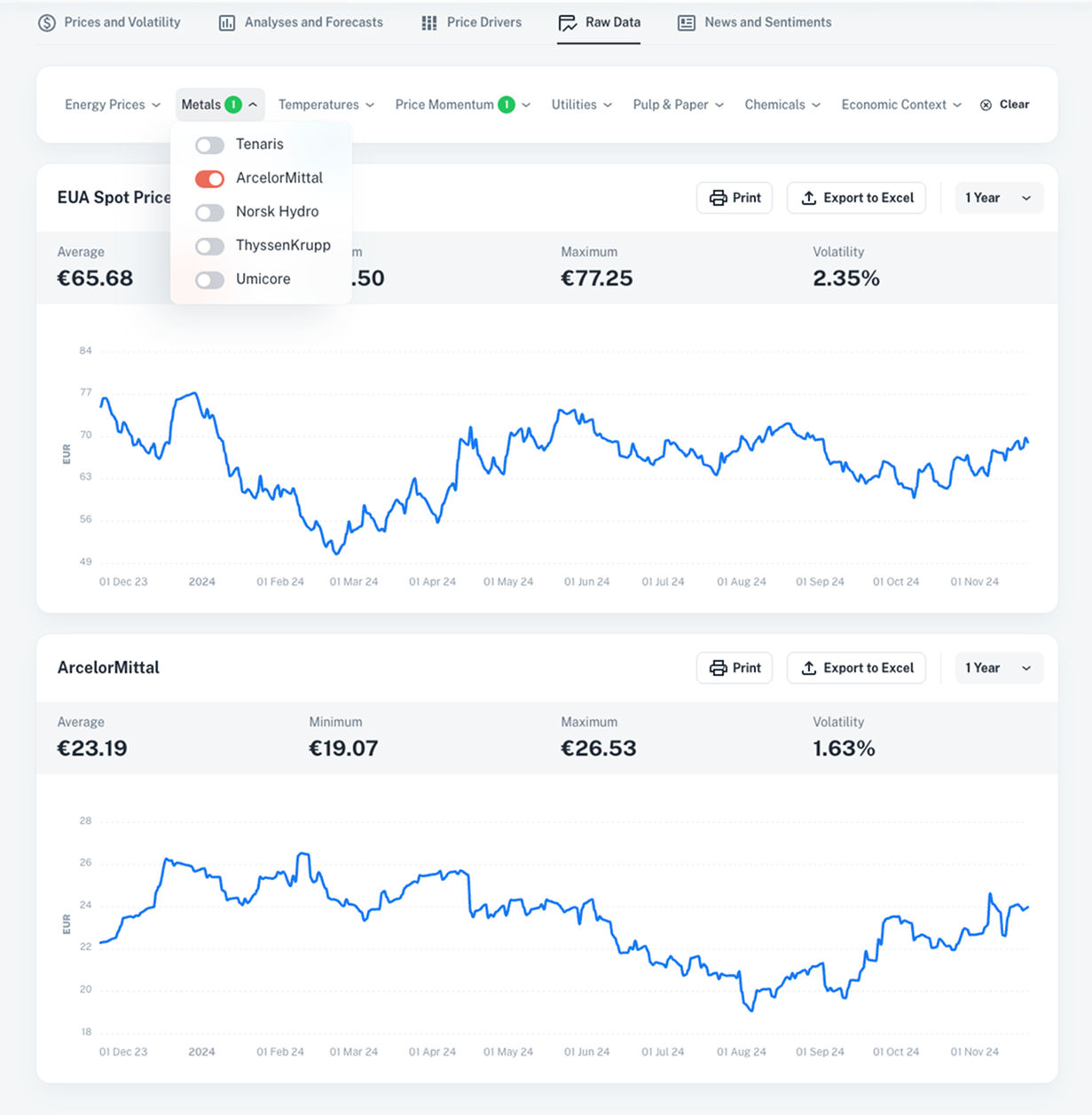

Prices & Volatility

Instant Market Insights

Benefit

Benefit

Know your market instantly and react proactively.

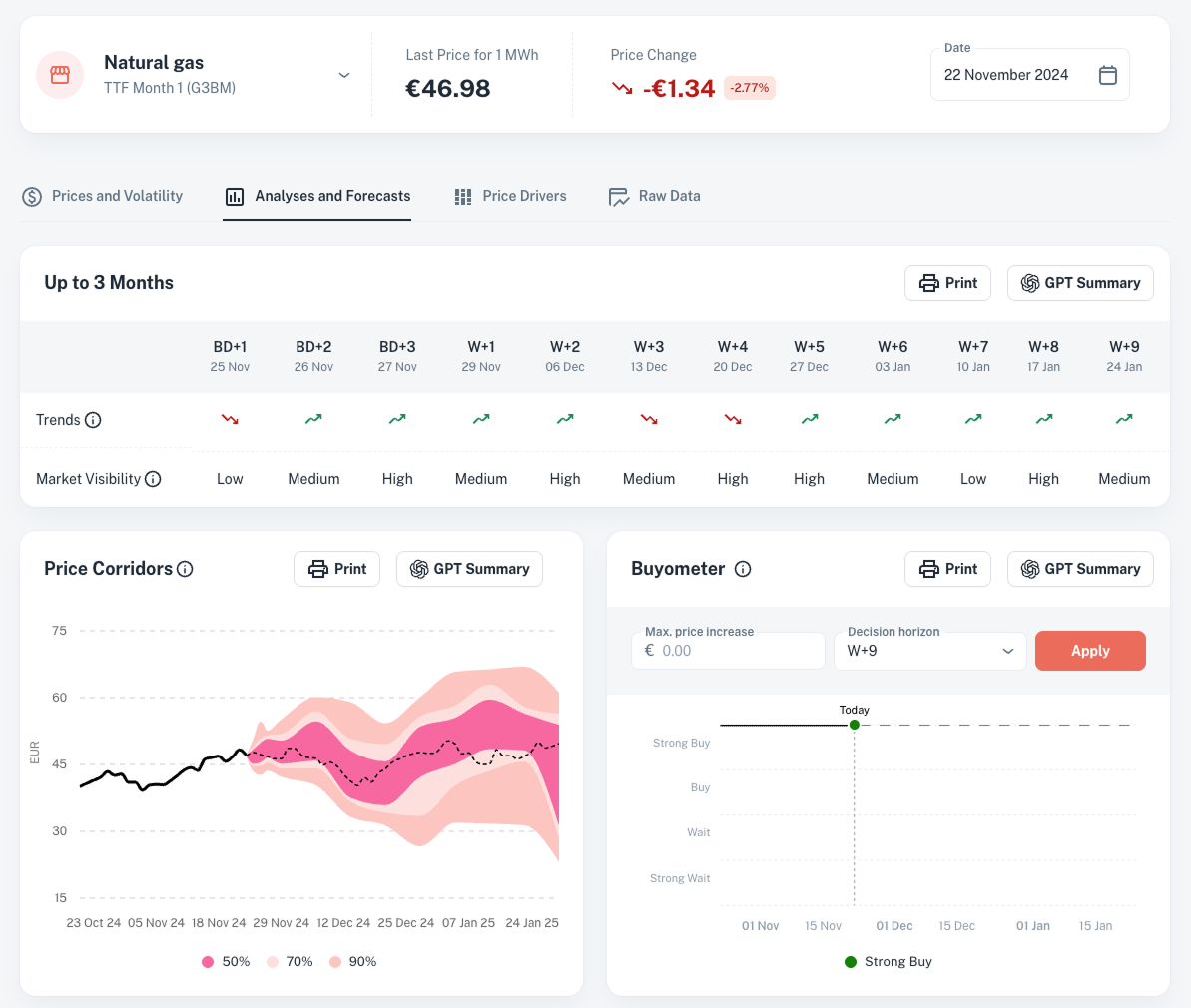

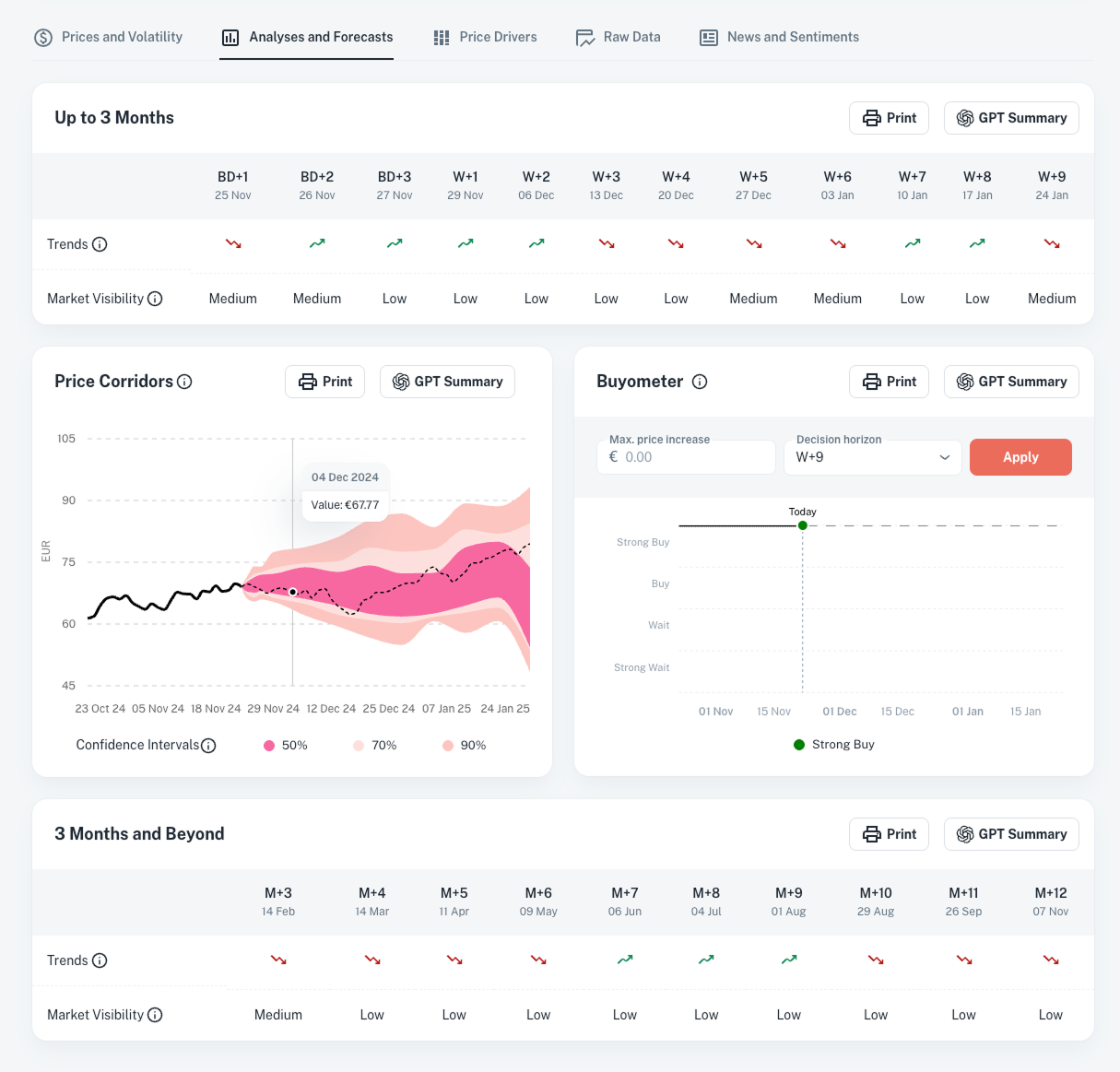

Analyses & Forecasts

AI-Powered Price Projections

Benefit

Benefit

Adapt to market regime changes, monitor prediction accuracy, and assess model performance over time.

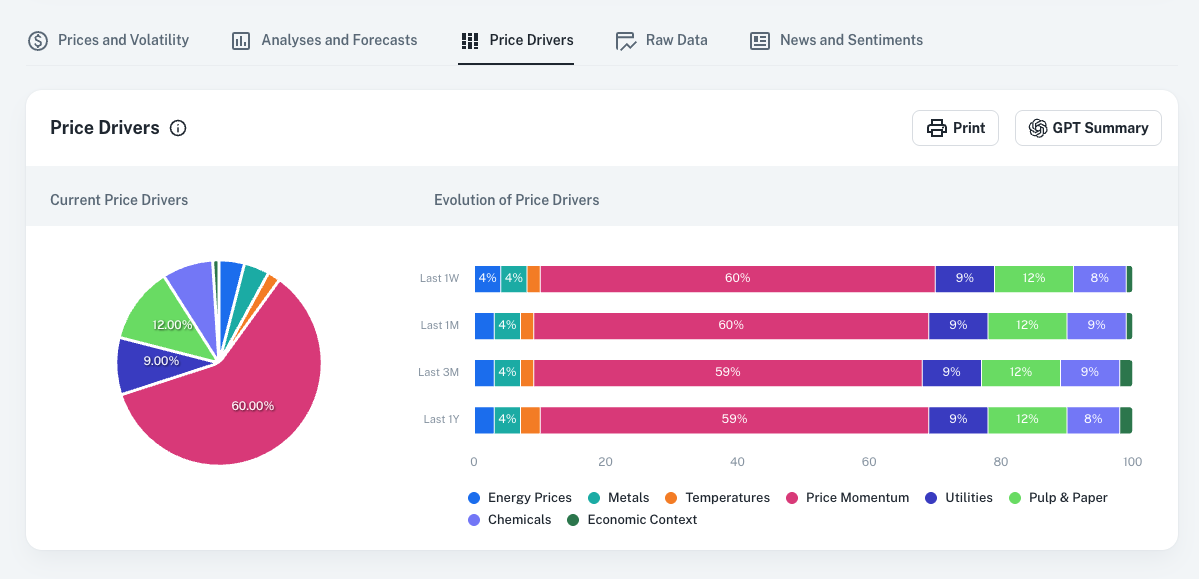

Price Drivers

Understand What Drives Your Market

Benefit

Benefit

Focus on the most relevant data streams and avoid unnecessary data costs.

Data Stream Selection

Optimize Your Market Intelligence

Benefit

Benefit

Ensure that your forecasting models rely on the most relevant and cost-effective data.

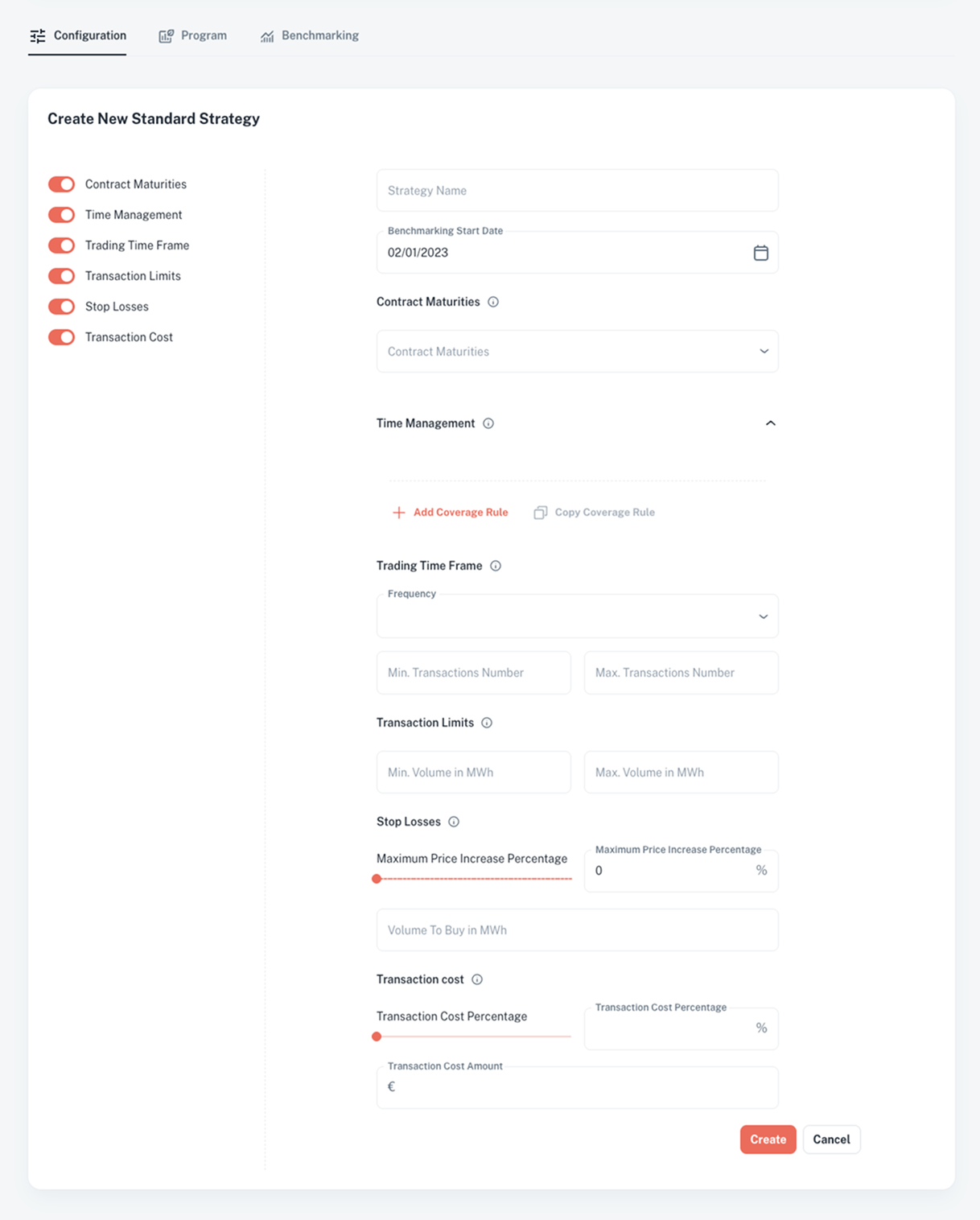

Configuration

Design & Test Multiple Strategies

Benefit

Benefit

Test all the purchasing / hedging strategies you’ve ever wanted in a safe and protected environment.

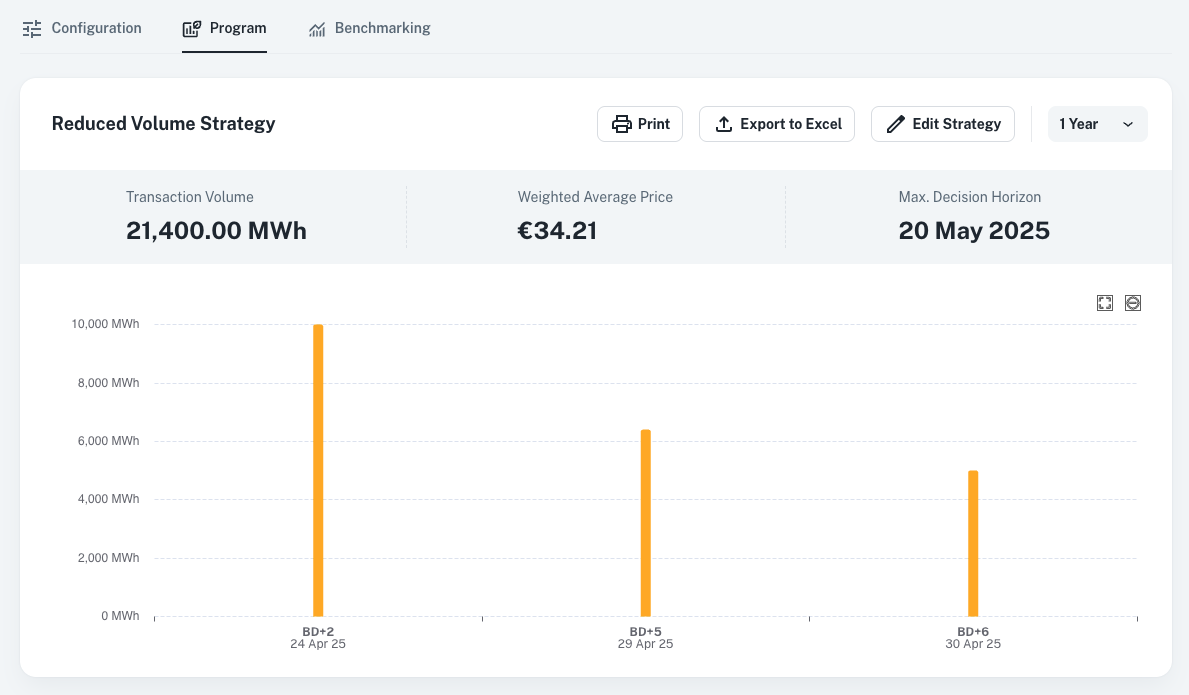

Program

AI-Powered Strategy Execution

Benefit

Benefit

Gain first-class AI-driven recommendations while keeping full decision-making autonomy, and reduce annual costs by 2-5%.

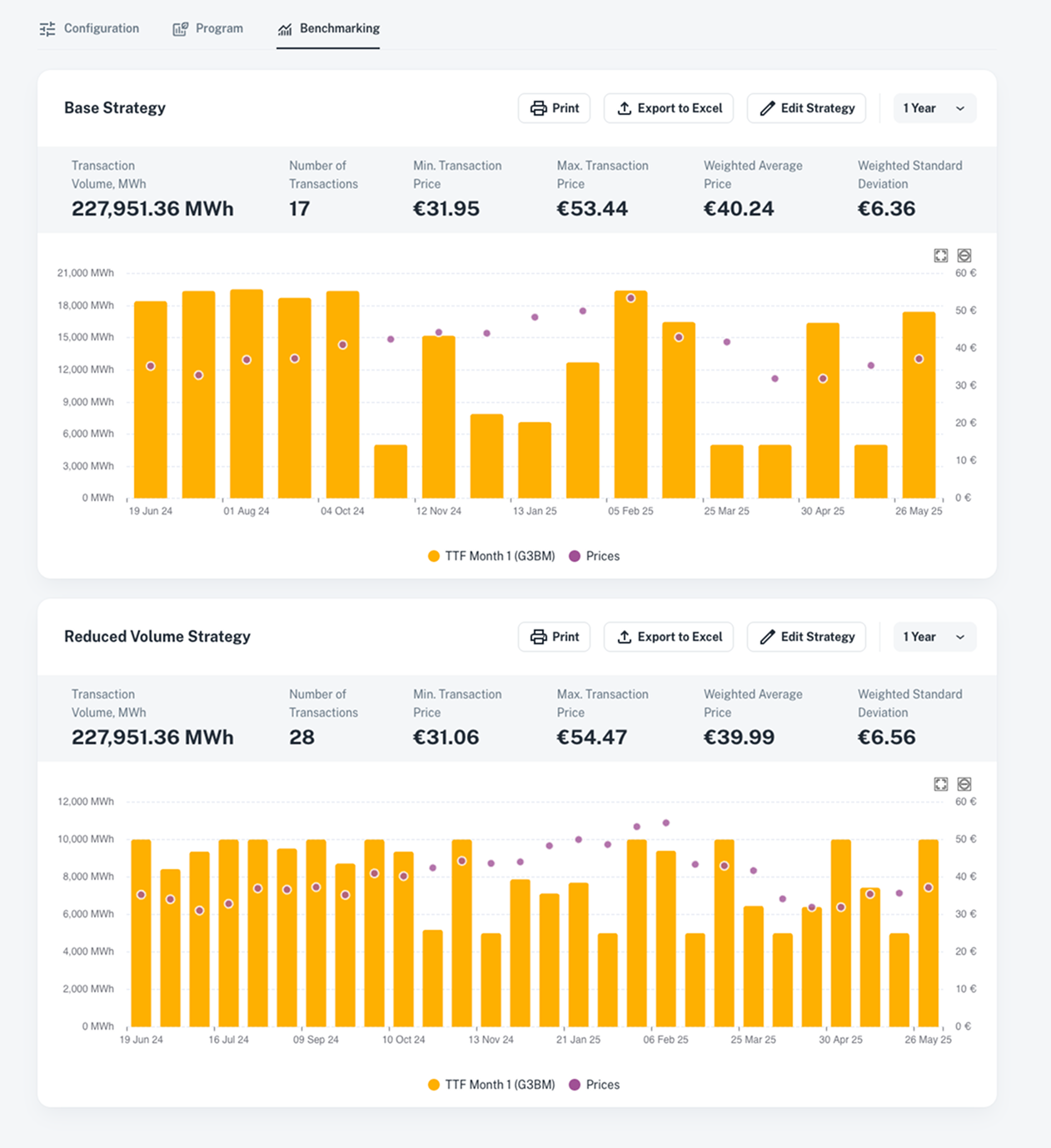

Benchmarking

Compare & Optimize Performance

Benefit

Benefit

Identify and select the most effective purchasing / hedging strategies, and continuously monitor them.

Fit with Your Market

Procurement professionals : gain visibility and reduce costs.

Manage energy procurement with real-time AI-driven insights.

Optimize hedging, forecast demand, and secure supply stability.

Gain visibility into oil-based material markets with real-time AI insights.

Optimize sourcing strategies, anticipate cost fluctuations, and improve contract negotiations.

Stay ahead of agricultural market trends with intelligent analytics.

Forecast seasonal variations, reduce exposure to volatility, and streamline procurement planning.

Take control of metal procurement with dynamic market intelligence.

Respond to price shifts, forecast demand accurately, and ensure supply continuity at the best cost.

Turn Real-Time Data into

Confident, Cost-Saving Decisions

Turn Real-Time Data into Confident, Cost-Saving Decisions.

Helping companies optimize their purchasing strategies, mitigate market risks, and drive better decisions through advanced data insights and forecasting.

Consolidate & Visualize Energy and Raw Material Consumption

Say goodbye to scattered spreadsheets. Get a clear, centralized view of your consumption data and save valuable time.

Discover More

Centralize & Analyze All Historical Transactions

Streamline your processes with one centralized tool delivering instant insights into your procurement past.

Discover More

Prices & Volatility : Instant Market Insights

Stay on top of price fluctuations and act with confidence, before volatility impacts your costs.

Discover More

Analyses & Forecasts : AI-Powered Price Projections

Leverage advanced forecasts to align purchasing decisions with future market conditions.

Discover More

Price Drivers : Understand What Drives Your Market

Identify the variables that matter most to refine your strategy and eliminate data noise.

Discover More

Data Stream Selection : Optimize Your Market Intelligence

Choose only the most relevant data inputs to reduce complexity and control data costs.

Discover More

Configuration : Design & Test Multiple Strategies

Explore different purchasing and hedging scenarios in a risk-free environment to find what works best.

Discover More

Program : AI-Powered Strategy Execution

Execute AI-enhanced decisions while keeping full ownership, and reduce your procurement costs by up to 5%.

Discover More

Benchmarking : Compare & Optimize Performance

Compare the impact of your different strategies over time and continuously optimize performance.

Discover More

Take the next step

Explore the benefits and value Datapred brings to your company.