It is inevitable: the sight of rising prices always reminds us of the cost of missed buying opportunities.

But with modern technology, industrial buyers of raw materials and energy may not be as ill-fated as they seem these days.

A procurement digital twin such as Datapred will not prevent price increases, but will bring distinct benefits to buyers.

The procurement digital twin

Gartner's definition of a digital twin is:

Enterprise software that implements a virtual representation of a connected entity or process, used to provide situation awareness that helps improve business decision making and outcomes."

The key point for us is that digital twins can mirror business processes, not just physical assets.

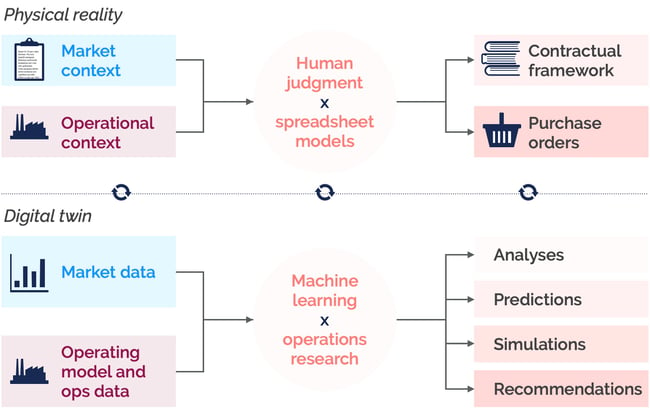

As discussed in an earlier article, Datapred's digital twin for industrial raw material and energy buyers looks like this:

Live market and operational data streams boost situational awareness, while the combination of machine learning and operations research creates a malleable and always-on proxy for human judgment.

Four benefits when prices are rising

1. Identification of price drivers

Sure, raw material and energy prices have been steadily increasing since last September.

But why?

Prices may be increasing for different reasons at different times. We have seen this recently with European CO2 prices: in early 2021, energy suddenly superceded temperature and the economic health of the metal industry as the leading advance EU Allowance price indicator.

Identifying and quantifying price drivers in real time provides three notable benefits.

- It complements traditional market analysis. Qualitative discussions of supply/demand imbalances, industry megatrends, market sentiment... are interesting, but they are low-speed and tend to leave the "so what" question unanswered. A quantified assessment of what is driving prices right now ensures sound decision making.

- It is the foundation for meaningful simulations. Once you know that, for example, energy prices explain 17% of recent metallurgical coal price movements, you can simulate the short or mid-term impact of a given energy price increase in metallurgical coal prices.

- It increases natural hedging effectiveness. Industrial raw material buyers like "natural hedges". For example, a producer of nitrogen-based fertilizers will be naturally protected against energy price hikes. Qualitatively, such natural hedges are usually quite obvious. Continuous price driver identification and quantification help with the tough part, which is to get the natural hedge composition and transaction timing right.

2. Short-term tactical optimization

Raw material and energy buyers that make frequent buying or hedging decisions can leverage the predictive capabilities of a procurement digital twin, and optimize transaction timing x volume.

It's a numbers game. Our experience across raw materials and energies shows the potential for 3-5% savings, year over year, provided that:

- You are making at least 2-3 buying or hedging decisions per month.

- The weekly price volatility of your raw material exceeds 2%.

- We can anticipate price trends with a minimum 55% accuracy.

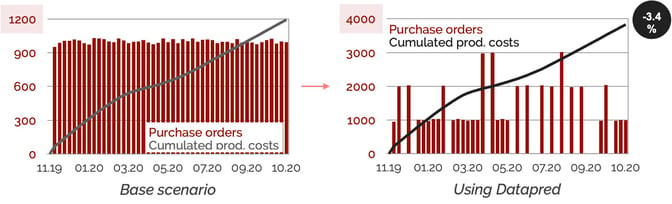

For example, a naphtha buyer transacting once a week would have saved 3.4% during 2020 using 1 to 4-week price predictions from Datapred, as summarized below.

3. Mid-term planning

As you would expect, price prediction accuracies tend to decrease when prediction horizons increase. Until we reach a horizon (which varies from one material or energy to the next) where point price predictions don't really make sense anymore.

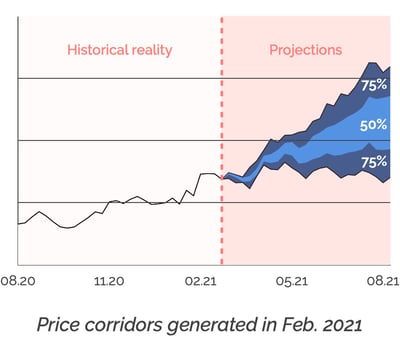

But the predictive module of your digital twin can include other quantitative tools that provide visibility beyond that horizon, like price corridors for example:

The goal here is not short-term tactical optimization, but mid-term procurement, commercial and financial planning. Where are raw material prices likely to land? How would that affect our own pricing policy? Which consequences for our income statement?

4. Safe experimention

Rising prices are a strong incentive for experimenting, and there are so many parameters industrial raw material buyers can play with: the split between spot and term-based transactions, the price adjustment mechanisms of supplier agreements, the company's inventory management policy, the company's hedging rules...

With a digital twin, buyers can test the likely impact of new tactics and strategies in a realistic but safe environment, before rolling out the most promising improvements.

They can also use the digital twin to monitor potential differences between theory and practice during the roll-out, identify their root causes, and adjust in real time.

***

Deploying the right digital procurement solutions will increasingly separate winners and losers. For industrial buyers of raw materials and energy, a digital twin dedicated to the buying process is a great place to start.