The Covid-19 crisis is having a violent impact on energy and raw material markets. But the traditional concept of price volatility doesn't capture the many aspects of that instability, and is actually misleading in some cases. Chief Procurement Officers need finer insights to optimize buying decisions in the post Covid-19 world.

Let us illustrate this with the examples of steel in China and natural gas in France.

Steel in China - Fire beneath the ice

Despite China's 6.8% GDP drop in Q1 this year, Chinese steel prices have continued the moderate downward trend that started in 2019:

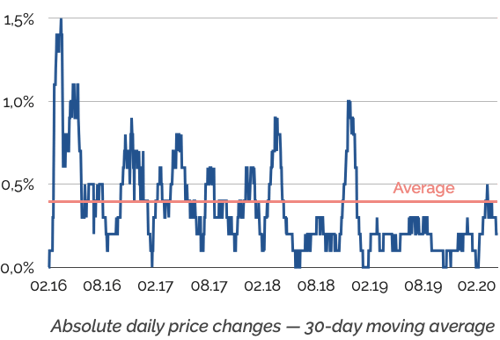

Contrary to what you would expect, price volatility also seems unaffected by the Covid-19 crisis, and is currently navigating below its historical average:

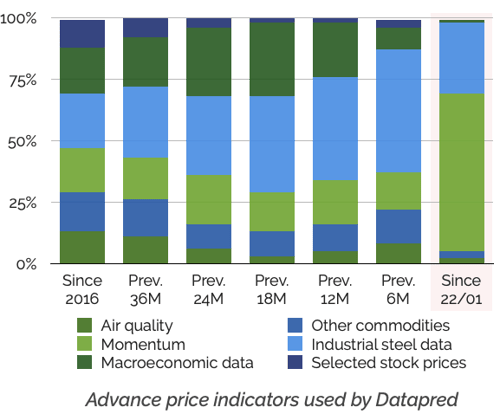

But that apparent stability hides a dramatic shift in market dynamics. We can see this when we look at the advance price indicators that Datapred is automatically selecting for Chinese steel prices:

Since 2016, macroeconomic data and industrial steel data had been our main advance indicators. Adding other commodity prices, selected stock prices and air quality, contextual indicators contributed 60-80% of Datapred's predictive performance on that market.

But since January 22nd and the first lockdowns in China, contextual indicators have become useless. Price momentum has jumped from an average contribution of 15% to a Covid-19 contribution of 65%.

The price trend is unchanged, traditional price volatility is flat, but market dynamics are so new that Datapred is telling us "you know what, I don't understand context anymore, I'll just make the most of recent price movements".

For Chinese steel, instability is like fire beneath the ice: burning market dynamics underneath a cold layer of monotonous price trend and low price volatility.

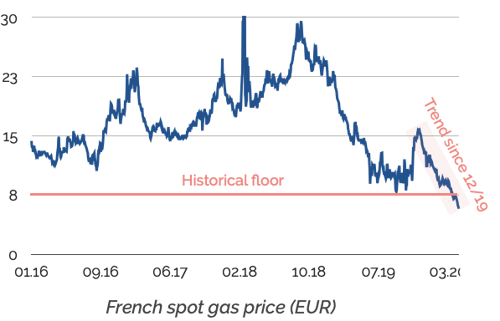

Natural gas in France - Titanic orchestra

The price of natural gas in France has dropped below its historical floor since the beginning of the national lockdown on March 16th, mirroring the larger economic crash. But that seems like the continuation of a downward trend that started in December 2019:

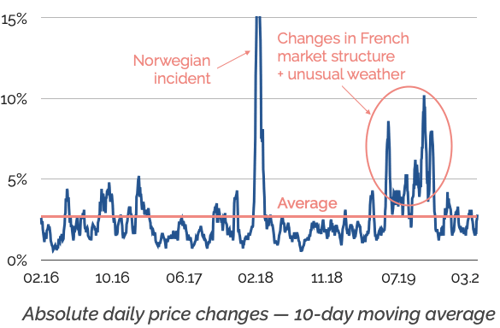

Like steel in China, market instability hasn't translated into price volatility. Technical changes in the structure of the French natural gas market, coupled with unusual weather conditions, had a greater impact on price volatility last summer than the current crisis:

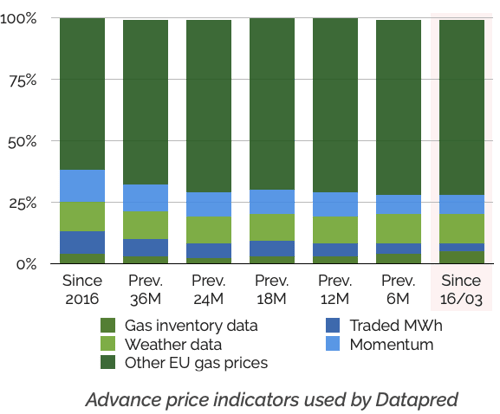

Finally, advance price indicators haven't changed. Other European gas prices and weather conditions continue to contribute 85% of Datapred's predictive performance on that market, and price momentum 8-10%:

We are thus reminded of the orchestra of the Titanic: price is sinking but price trend, price volatily and advance price indicators continue to play the same music.

So what should Chief Procurement Officers do?

Instability has undoubtedly increased in both our examples, but taking very different shapes. We see three lessons for corporate buyers wishing to reduce their energy and raw material spend in our post Covid-19 world.

- The qualitative analysis of macroeconomic trends and industrial data is clearly not enough. It is too slow and neglects too many price drivers. Our steel-buying client in China would be lost if Datapred ignored more reactive advance price indicators.

- Volatility analysis is a staple of modern finance, but doesn't provide a complete picture of market instability. Looking at price volatility only, we would conclude that all is quiet on the Chinese steel and French natural gas fronts - and that would be ridiculous.

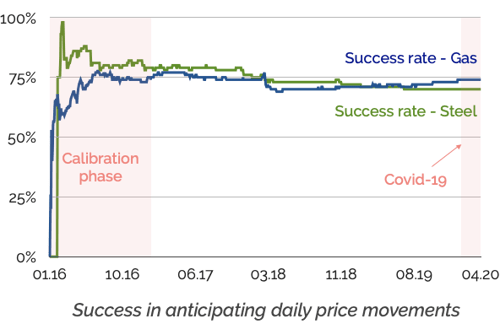

- From a modeling perspective, flexibility is the name of the game. Continuously combining many types of data and predictive models is key to maintaining predictive performance regardless of context. For steel in China and natural gas in France, the Covid-19 crisis has not affected Datapred's ability to anticipate price trends:

***

Dont hesitate to contact us to discuss the market analysis capabilities of Datapred. You can also check our page on digital procurement for more examples of machine learning applications along the source to pay process.