Price volatility is exploding, supply chains are shaking, conflicting objectives are multiplying... Energy and raw material buyers are under pressure to adapt. How can they foolproof their revised strategies?

This article discusses four ways technology can help buyers build confidence in their buying/hedging strategy updates.

1. Quantify trade-offs

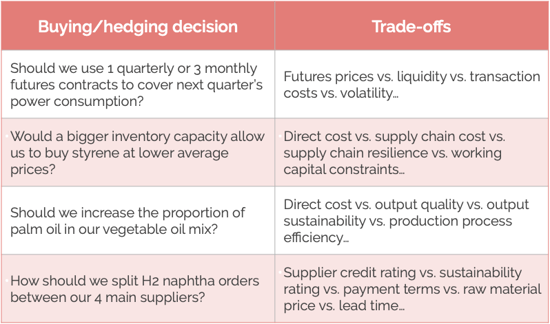

For industrial buyers, buying/hedging decisions involve lots of trade-offs - related to market and/or industrial conditions. The following table offers selected examples (the full list is endless):

Most companies still resolve the trade-offs they are aware of "by hand" - based on experience and simple calculations.

Free download

Direct material procurement - What to expect from machine learning

That was acceptable when market and industrial conditions were stable. But it has become both impossible and dangerous.

- Impossible because trade-off complexity grows exponentially with the number of decision factors. Optimizing for 4 parameters is already too much for the human mind (with 3 potential values per parameter, that's 81 possibilities to assess).

- Dangerous because in today's conditions, hidden, overlooked or misunderstood trade-offs could tank your career. It is OK to favor resilience vs. cost, sustainability vs. margins or reactivity vs. stability, but you should do it consciously and with a quantified rationale.

With technology, you can use "brute force" to explore and rank solutions to known trade-offs. But even more interestingly, feeding decision factors to a solver will yield optimal solutions to known trade-offs and "black swans" (unknown trade-offs) alike. That's considerable peace of mind for energy and raw material buyers.

2. Perform back and stress tests

Backtests and stress tests are staples of market finance that industrial energy and raw material buyers should absolutely leverage for strategy validation.

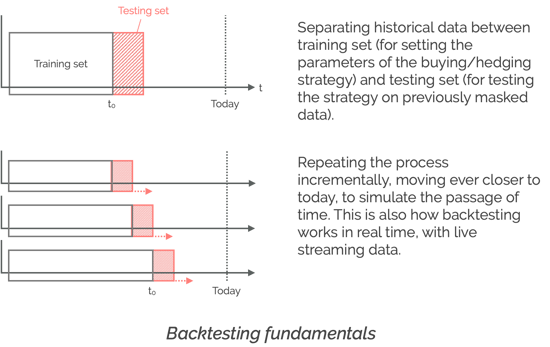

- Backtesting a strategy means replaying it and measuring its outputs over the past, without cheating - i.e. always "hiding the future". Here is an illustration:

And yes we all agree that "past experience is not a perfect predictor of future performance", but until someone invents the time machine, what are we gonna do? It would be irresponsible to skip backtests under that guise. They are an indispensable tool in your decision-making toolbox. - Stress testing is like backtesting, but with altered, more demanding values for key data streams and decision factors. For example, you could backtest a buying strategy for styrene, assuming less inventory capacity, higher oil prices, longer lead times... Or you could backtest a gas hedging strategy assuming less liquidity on gas futures markets, higher transaction costs, higher price volatility...

A key point is that stress tests can be market-oriented (e.g. higher prices, lower liquidity), but also business-oriented (e.g. longer lead times, diminished working capital). The goal is to check how your buying/hedging strategy behaves when you "push the decision-making envelope".

While it is technically possible to perform back and stress tests with Excel (banks were doing it until 20 years ago), it is very error-prone, and requires a level of proficiency far beyond mere mortals.

Technology will handle the complex calculations and let you focus on assumptions and conclusions (of course lifting the hood and auditing these calculations should remain possible).

3. Compare scenarios

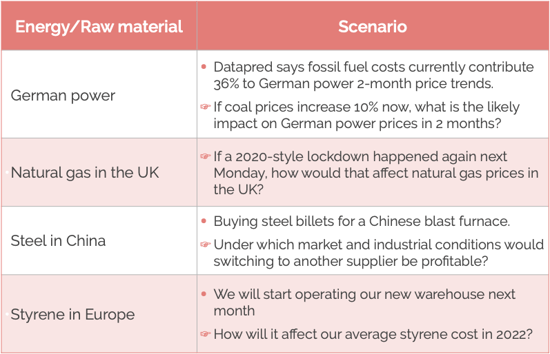

In spirit, scenario-building is similar to stress-testing: it is about exploring how a buying/hedging strategy would fare under changing circumstances.

The difference is that while stress-tests are typically backward-looking, scenarios are usually forward-looking:

Technology will help you "keep the scenarios honest" in two ways:

- By preserving basic relationships between the parameters of your decision-making problem, even while your are speculating on potential market and industrial disruptions. Machine learning in particular is very good at detecting such relationships, then letting you twist them without breaking them.

- By ascribing degrees of likelihood to your scenarios. Like the backtests described above, these probabilities will be based on historical data analysis, with the corresponding limitations. But again, for informed decision-making that is much better than sentiments,

4. Use benchmarks

For backtests, stress tests, scenarios and continuous performance monitoring, we strongly recommend benchmarking your buying/hedging strategy.

It works like this:

- Select a basic, yet legitimate strategy. That could for example be the "mechanical strategy" (aka the "monkey strategy" to some people): every day, buying an equal fraction of the period’s requirement at the price of that day.

- Generate mock buying/hedging transactions based on that strategy, and taking into account your usual decision parameters (costs, constraints, rules, targets...).

- Compare the outputs of your real strategy to these mock transactions. The goal is of course is to identify and maintain a strategy that adds value (or at a minimum doesn't destroy value) compared to the benchmark.

With technology, you can automate the continuous generation of mock transactions and comparison between these and what you are actually doing. Monitoring the gap between mock and actual transactions is a good way to ensure your chosen buying/hedging strategy stays current.

***

The Datapred digital twin helps industrial energy and raw material buyers select and implement the right strategy, automating most processes described above. Don't hesitate to contact us to discuss how the solution would work in your context.

You can also visit this page for more resources on digital procurement.