Buying raw materials means constantly juggling with multiple, overlapping time windows. It can prove a little confusing...

This article provides definitions and examples for the 12 time windows that Datapred for Procurement manages.

Data management and science

Data frequency

☞ The time interval between data points.

Industrial buyers will typically need daily or weekly data, unless they are working on fast markets like energy or listed foodstuff.

Data frequency must roughly align with decision frequency (see definition below): daily decisions based on weekly data will be weak, and hourly data for weekly decisions is overkill.

Historical depth

☞ The amount of historical data required for training, validating and testing (see definitions below) analytical and predictive models.

We like to use at least five years of weekly data or two years of daily data.

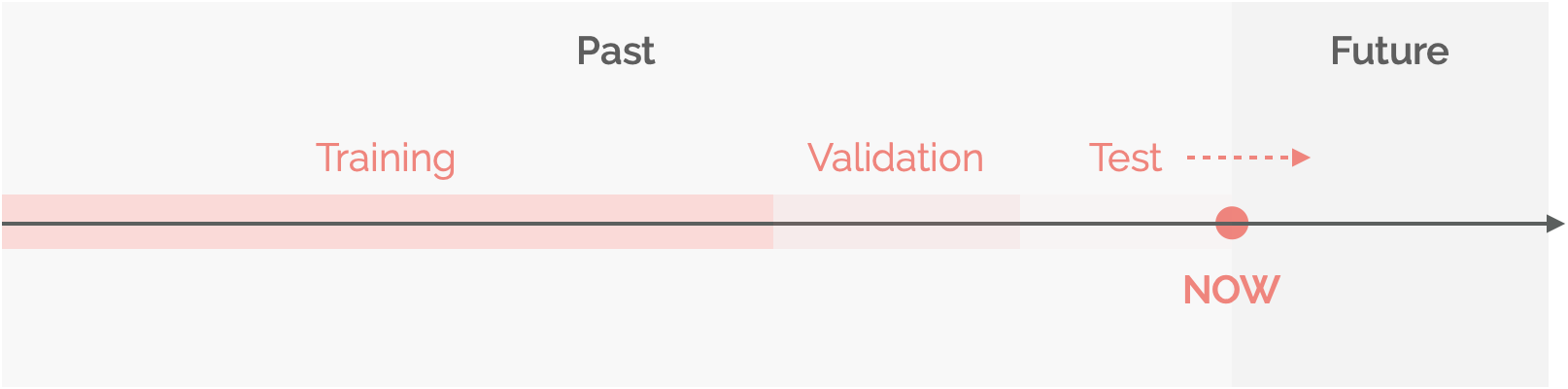

Training, validation and test sets

☞ The training set, validation set and test set are three partitions of historical data used to calibrate analytical and predictive models:

The trick for robust results is always to hide the next period(s) from the models: the validation and test sets when models are training, and the test set when they are validating.

When in production, reality itself, as it gradually unfolds, is the test set. The past (either extending or sliding) is the constantly-updated training and validation sets.

Predictions

Discussing predictions involves tricky mental time travelling, as illustrated here:

Understanding the concepts of "prediction time" and "prediction horizon" minimizes confusion.

Prediction time

☞ The time at which I am making the prediction.

That would be "3 weeks ago" in the illustration above, or "today" in the following sentence: "today, I am predicting that prices will increase next week".

Prediction horizon

☞ The time for which I am making the prediction.

That's 2 and 5 weeks in the illustration above, and "next week" in: "today, I am predicting that prices will increase next week".

Decision management

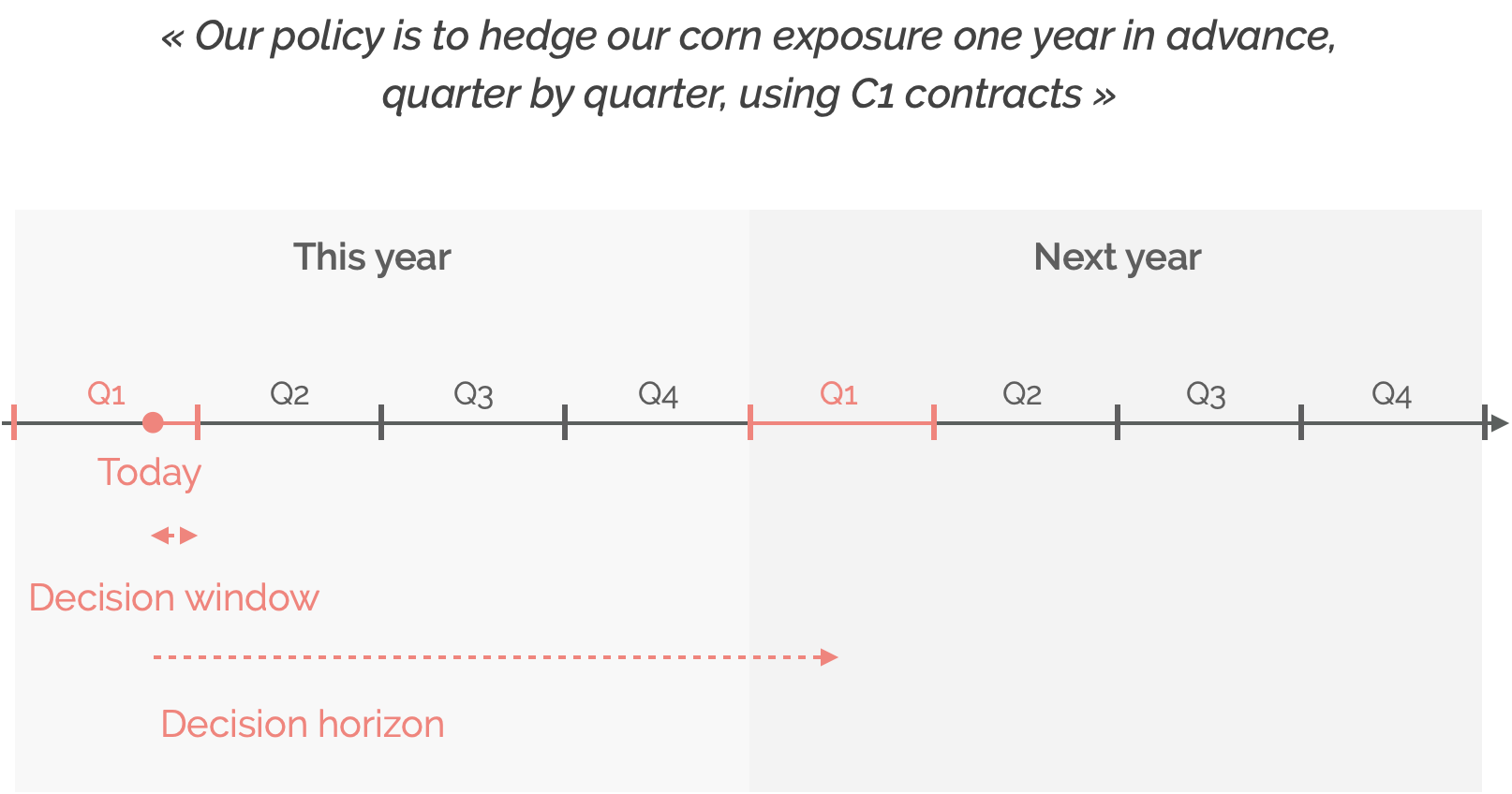

Decision window

☞ The time available to make my buying decision.

Suppose for example that I am in the following situation:

Today being March 10th, I still have 20 days to buy C1 contracts for Q1 next year. My decision window is 20 days.

Decision horizon

☞ The time for which I am making the decision.

In the illustration above, Q1 next year, or 12 months ahead.

Decision frequency

☞ How often I need to make buying decisions, or to reassess my buying strategy.

Buying instruments

Contract term

Spot is spot, but industrial buyers often use term-based contracts - listed (like futures and swaps) or OTC (with individual suppliers).

☞ The contract's term is the time for which the contract is agreed.

For example, two months from now in the case of a M2 future.

Price frequency

☞ The time interval between price points.

Varies from a few seconds for listed commodities, to potentially several months in particularly rigid OTC term-based contracts.

***

Dont hesitate to contact us to discuss how Datapred helps raw material and energy buyers make the right decision at the right time. You can also check our page on digital procurement for more examples of machine learning applications along the source to pay process.