Stay on top of energy and commodities markets

Access prices from most world markets.

Are you struggling to keep up with energy and raw materials markets developments ?

Get past and current energy and commodity prices, verifiable analyses and forecasts, and simple decision-support tools all in one easy-to-use place.

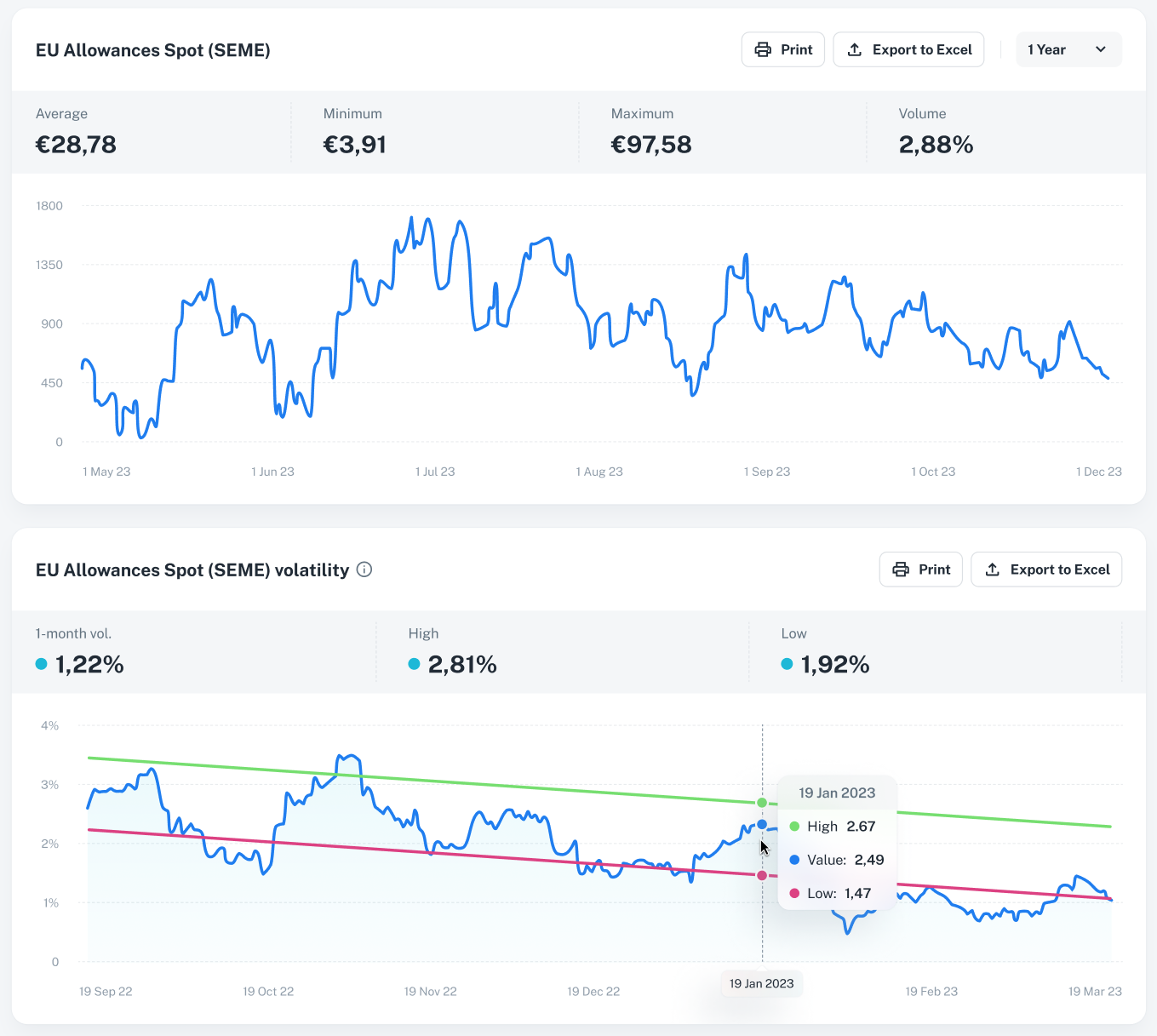

- You need to monitor energy and commodities prices and price volatility.

- You need to comment on market trends for internal stakeholders.

- You must transform analyses and forecasts into buying/hedging decisions.

- You want powerful, but not overpowering analyses that you can trust.

Prices of energy, raw materials, and other market data

Datapred is connected to EEX, and provides daily EEX prices, with over 15 years of downloadable historical data.

But to generate our proprietary analyses and forecasts, we also use lots of "contextual" data: other energy prices (like coal and oil prices), temperatures, macroeconomic indices, natural gas inventory levels...

You can visualize all that in datapred's Markets module, and download the data to Excel if required.

Energy and raw materials price forecasts

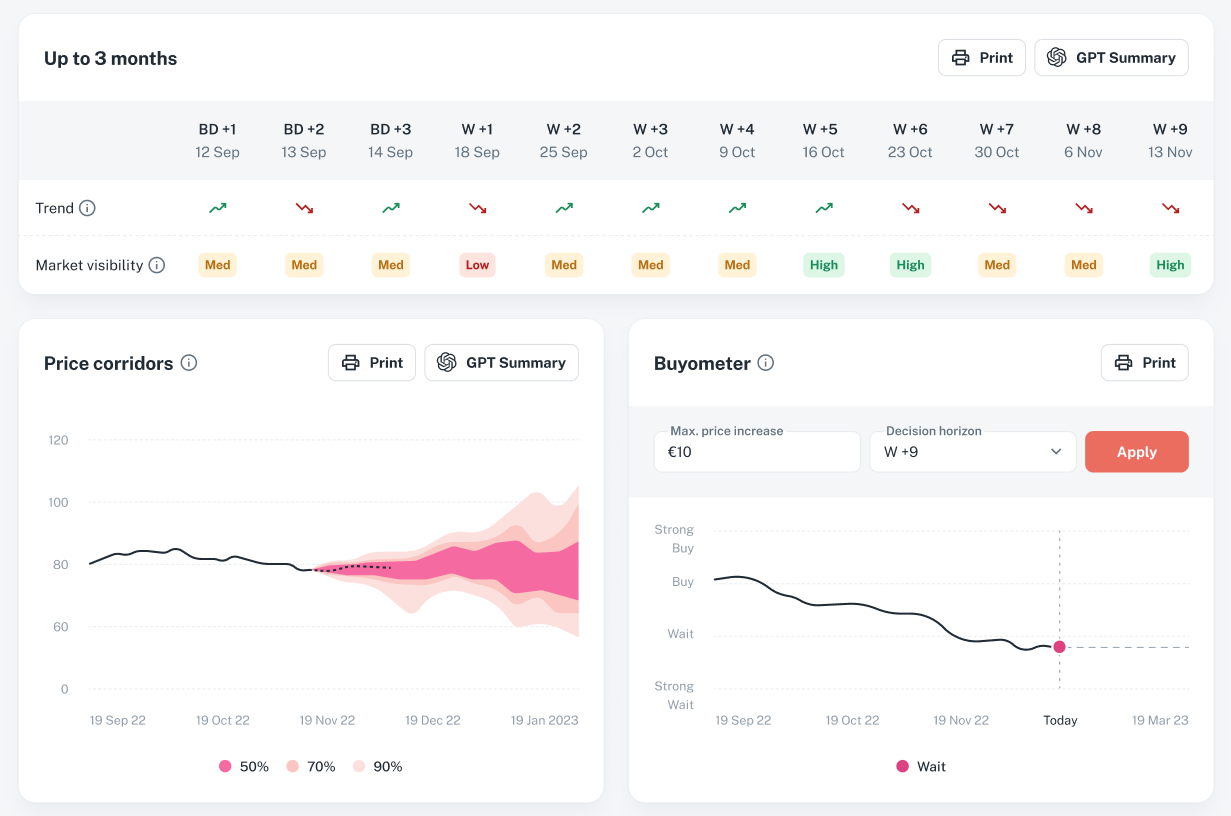

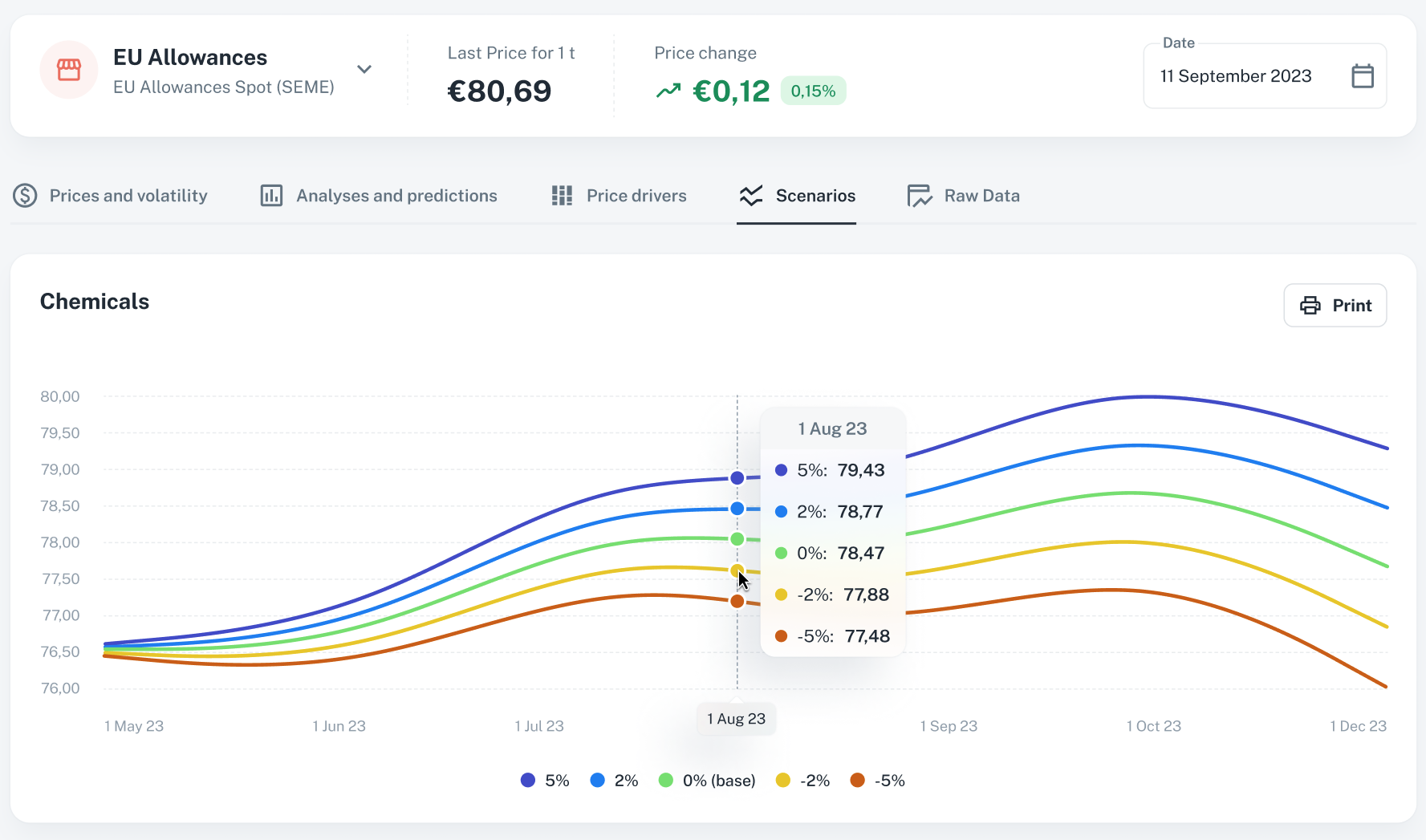

Datapred uses award-winning technology to provide price visibility to buyers, with multiple types of price forecasts: short and long term trend forecasts, price corridors, price simulations...

We check and update the calculations daily. Accuracy is transparent : from the user interface, you can navigate to any date in the past, and compare what we had anticipated and what actually happened.

Analyses and simulations

Datapred complements its price forecasts with analyses that help buyers understand where the forecasts come from, and how they could translate into buying or hedging decisions.

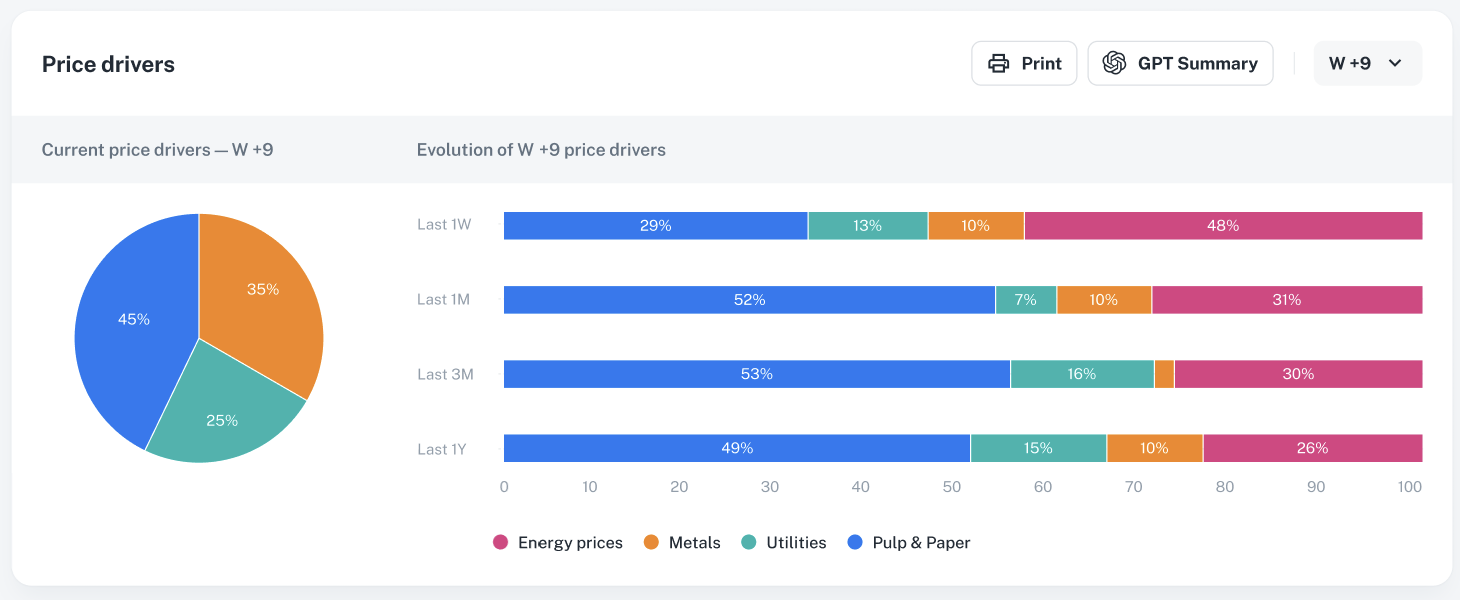

- The identification of price drivers : at any point in time, visualize which market forces are currently driving the energy prices you are monitoring. Temperatures, storage levels, the macroeconomic context...

- The buyometer : A nice proprietary tool that lets you test transaction ideas given market conditions, but also your own deadlines and risk aversion.

AI-powered insights

Datapred is a recognized leader in applying statistical, machine learning and optimization models to temporal data.

It may sound complex, but no stress : we also use generative AI to transform our quantitative outputs into simple narrative that you can cut and paste into internal documents and emails.

Just click the GPT icon top right of the analysis or forecast you are interested in.